Example Of Completed 941 For 2022

Example Of Completed 941 For 2022

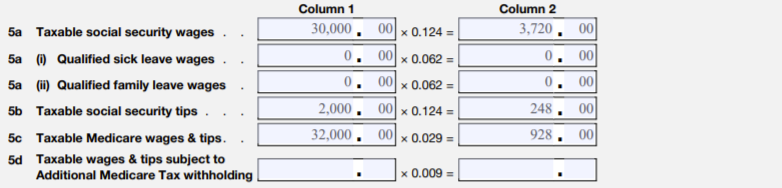

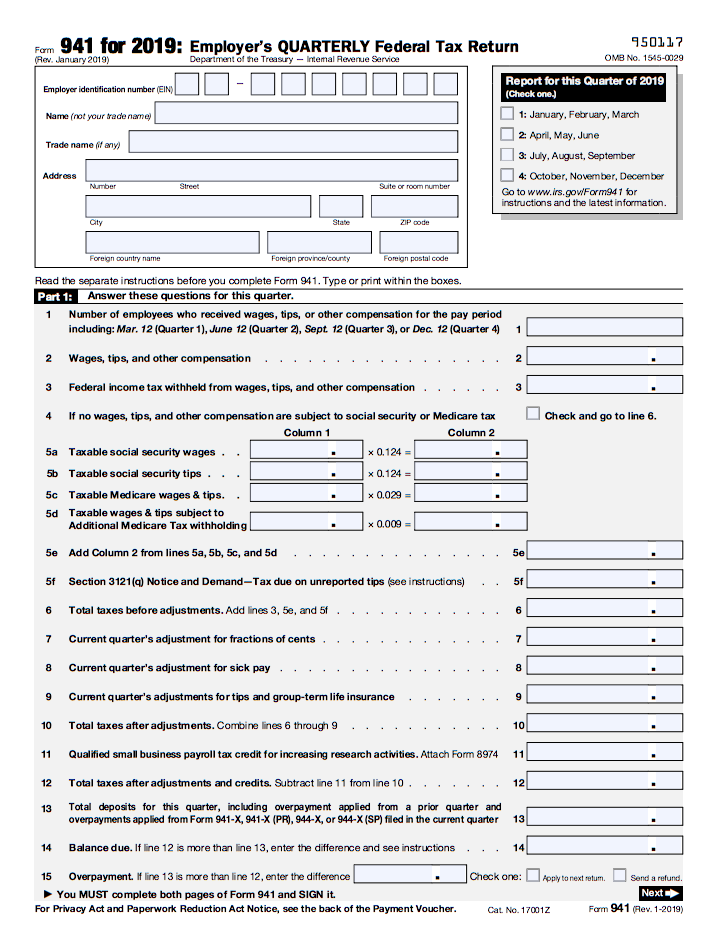

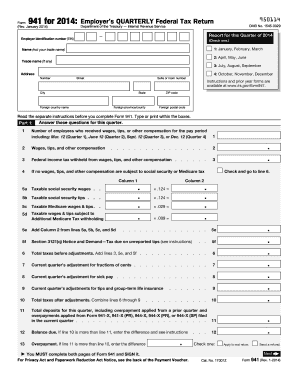

April 30 for the 1st quarter. Necessary to complete Worksheet 1 before preparing the Form 941. July 30 for the 2nd quarter. You may file Form 941-X and complete Worksheet 2 to claim the correct amount of the credit.

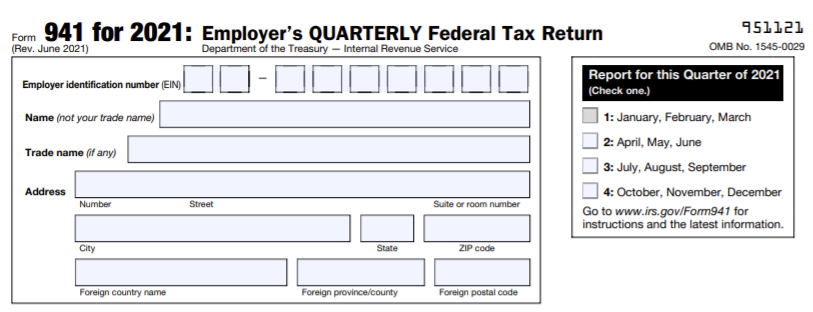

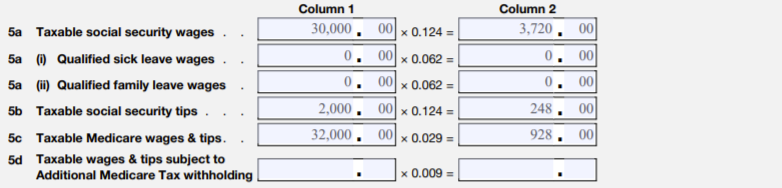

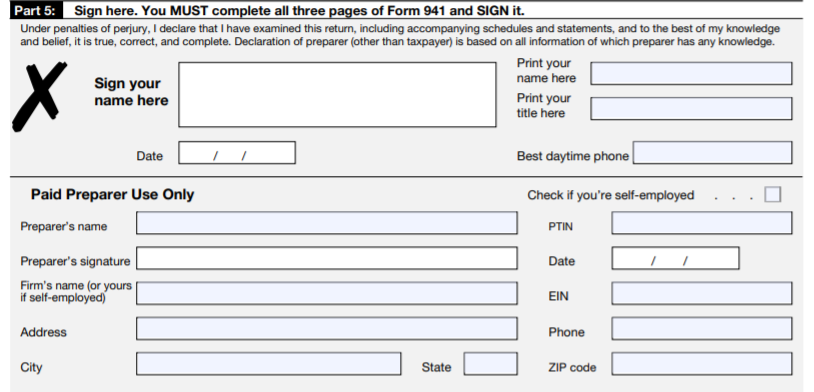

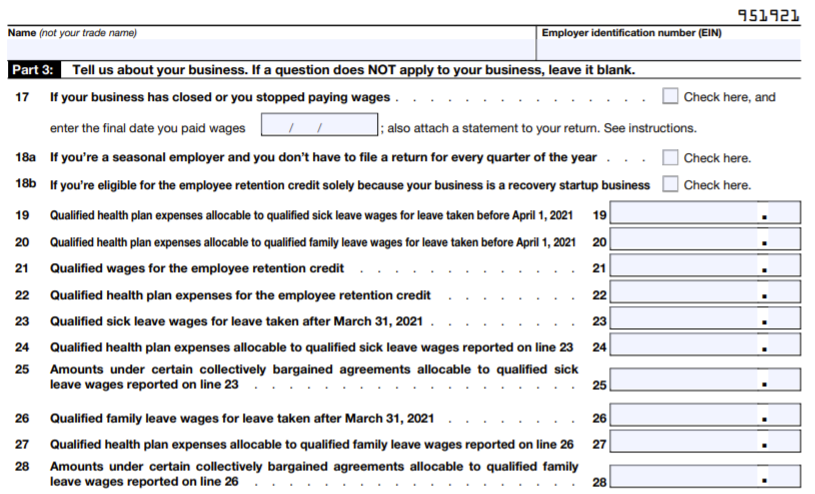

How To Fill Out Form 941 2021 Q2 Version Instructions

See Form 941 instructions pg.

Example Of Completed 941 For 2022. Form 941 is due a month after the quarter ends. October 30 for the 3rd quarter. Making Payments With Form 941 To avoid a penalty make your payment with Form 941 only if.

Likewise for the Form 941 third quarter deadline on October 31st. Credit for wages paid after June 30 2021 and before January 1 2022 third and fourth quarters. For example if the form is for the second quarter put an X in the box next to April May June.

2021 and before January 1 2022 later this year. Use a separate Form 941-X for each Form 941 that youre correcting. How to Submit Form 941.

How To Fill Out Form 941 2021 Q2 Version Instructions

How To Fill Out Form 941 2021 Q2 Version Instructions

How To Fill Out Form 941 2021 Q2 Version Instructions

.jpg)

Form 941 Worksheet 2 For Q2 2021 New Worksheet For 2nd Quarter

How To Fill Out Form 941 2021 Q2 Version Instructions

File 941 Online E File 941 For 4 95 Irs Form 941 For 2021

E File 941 Form Just 4 95 File 941 Online For 2021 2020

E File 941 Schedule R Aggregate Form 941 Schedule R For 2021

Form 941 Instructions How To File It Bench Accounting

22 Printable Form 941 Templates Fillable Samples In Pdf Word To Download Pdffiller

Creating And Revising A 94x Form Cwu

E File 941 Schedule R Aggregate Form 941 Schedule R For 2021

2014 Form Irs 941 Ss Fill Online Printable Fillable Blank Pdffiller

Creating And Revising A 94x Form Cwu

What Are The Changes In Irs Form 941 For 3rd Quarter 2020 Taxbandits Youtube

Updated Form 941 Worksheet 1 2 3 And 5 For Q2 2021 Revised 941

How To Fill Out Form 941 2021 Q2 Version Instructions

Post a Comment for "Example Of Completed 941 For 2022"