Letter 4883c For 2022

Letter 4883c For 2022

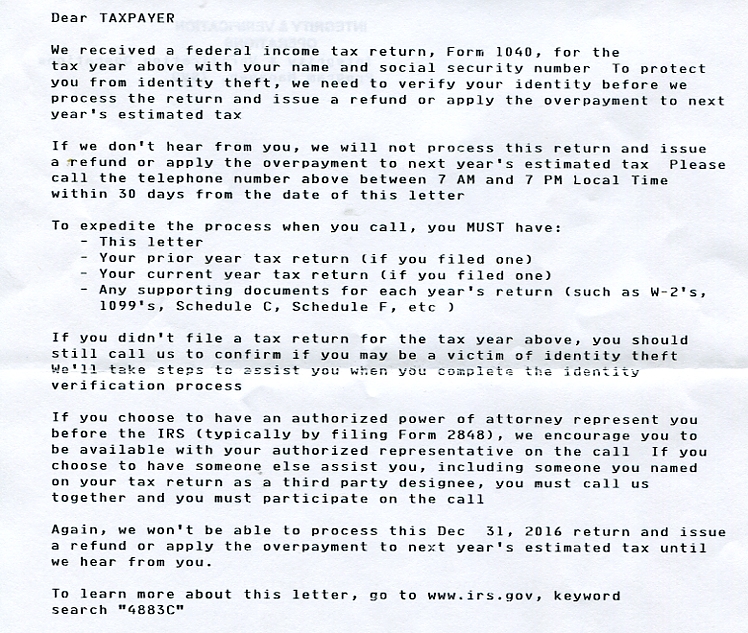

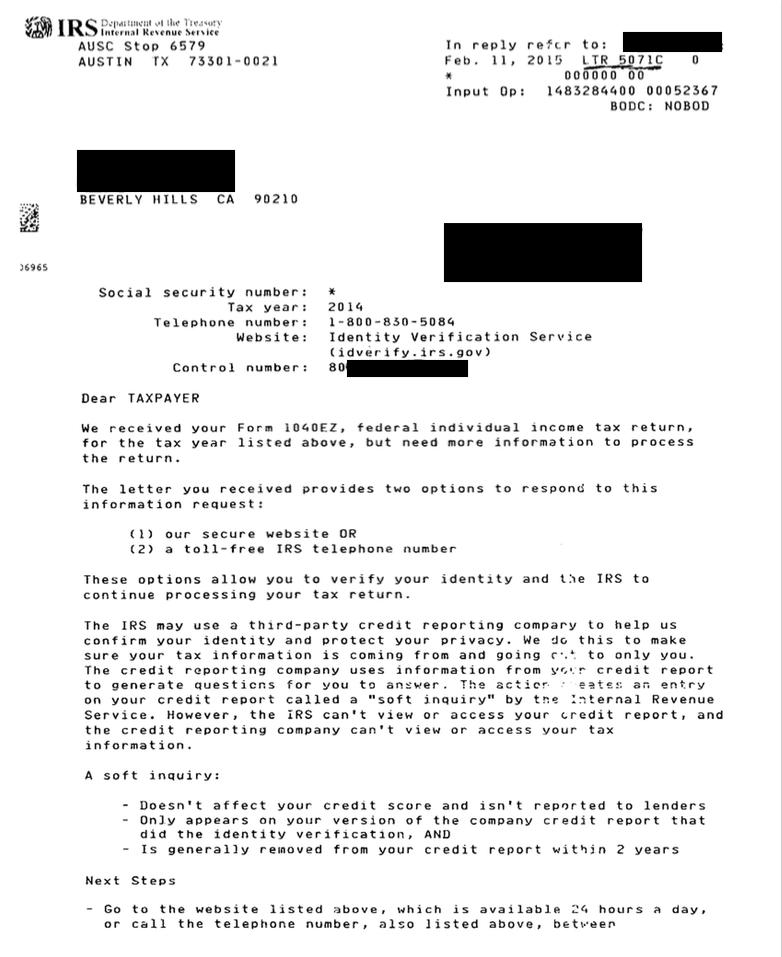

The above list is a sampling of the many letters sent to. The letter will provide two options -idverifyirsgov site or a toll-free number to confirm whether or not they filed the return. If you received a Letter 4883C follow its instructions. One way to be able to do this is to allow your employer know about your own retirement plans within a thoughtful and expert way which contains writing a particular type of resignation letter informing the organization of your retirement.

Irs Letter 4883c What It Means And How To Respond Supermoney

The IRS never sends any notices through electronic mail or social media it is likely the e-mail or text you received was fraudulent.

Letter 4883c For 2022. 2022 4883c aadhar aamc abandonment. IR-2020-160 July 16 2020 The Internal Revenue Service today announced its annual Dirty Dozen list of tax scams with a special emphasis on aggressive and evolving schemes related to coronavirus tax relief including Economic Impact Payments. Should My Husband File In 2022 So His 2021 Income Is Used To Calculate His Benefit.

If you get this letter from the IRS its legit. 4883C Identity Verification IRS needs the taxpayer to verify his or her identity before the return will be processed. Letter to collection agency on medical account reporting with a balance due letter to collection agency on medical account reporting as paid plus follow up dispute letter for both to cra this is only to be used when the hipaa letter to the oc can not be immediately used collection agency validationdisputecease and desist use this in its entirety.

The letter will be sent in January 2022 and should be given to your tax preparer with your other tax documents when preparing your return. Supporting documents that you filed with each years income tax return Form W-2 or Form 1099. Please find the notarized consent of mrs.

Irs Letter 4883c Tax Attorney Explains Options To Respond

Irs Notice 4883c Understanding Irs Notice 4883c Irs Needs More Information To Process Your Return

Irs Letter 4883c Vs 5071c Best Reviews

What It Was Like To Deal With A 4883c Letter From The Irs Swistle

Irs Issuing Letters Making Phone Calls To Collect Outstanding Debt

Irs Letter 4883c What It Means And How To Respond Supermoney

Irs Identity Fraud Filters Working Overtime Center For Agricultural Law And Taxation

Brinker Simpson Page 2 Of 21 We Re Here To Help We Re All In This Together

Irs Letter 4883c How To Use The Irs Id Verification Service

Irs Letter 5071c National Tax Training School

3 21 3 Individual Income Tax Returns Internal Revenue Service

Irs Clarifies Identity Theft Procedures Journal Of Accountancy

Tax Newsletter August 2020 Basics Beyond

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 Parts Of A Cover Letter Cover Letters

Warning Signs Of Tax Refund Fraud What To Do About It What Is Privacy

Post a Comment for "Letter 4883c For 2022"